Today's Fertilizer Market Is Like a Game of Jenga

This is the first part of a weekly, four-part series from LebanonTurf on the current state and forecast of the turf and ornamental fertilizer market.

Have you ever played a game of Jenga? It features a tower composed of wooden blocks, with the goal of strategically pulling out one of the blocks without causing the entire stack to collapse on your turn. If you’re the unlucky one who pulls the block that causes the whole tower to fall, you lose the game.

After watching and reporting on the T&O fertilizer market for the last two years, the game of Jenga is the best analogy that clearly illustrates our current market situation, which is undoubtedly built on an ever-moving, always-leaning tower. Every time someone removes a block, the stability changes. Since the fertilizer market is fundamentally built on the perception of stability, every little change is potentially challenging for all of us.

The last few updates we’ve provided were filled with disheartening news of continued supply shortages of raw materials, rising fuel and natural gas costs and some downright unpleasant predictions for the rest of 2022. Unfortunately, most of these forecasts actually came to be realized. So, it’s that time again to finish the Earl Grey and read the tea leaves at the bottom of the cup to offer some new market forecasts based on the latest global and national fertilizer market information.

Part One - The Current Commodity Positioning

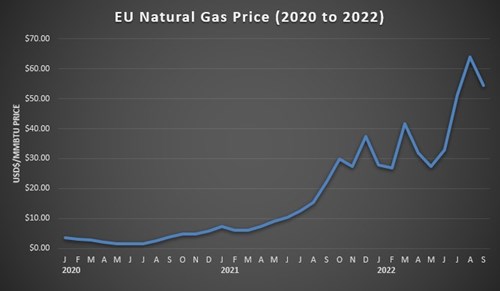

It’s probably best to start off with where the most relevant commodities to our industry are currently sitting. Typically, we would only include the pricing for urea, phosphate and potash in this update, but this time around we’re also including the European natural gas price; considering the direct impact it has on fertilizer production. It can be strongly argued that the European natural gas price is one the most significant and volatile factors dictating what you’re paying for a bag of fertilizer today. So, it only makes sense to keep an eye on this commodity as well.

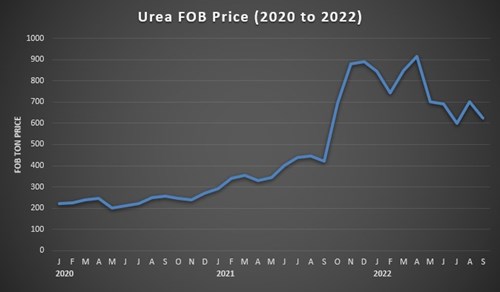

Urea Nitrogen

Urea nitrogen is still the biggest raw material component that impacts the cost of a bag of fertilizer and because of that, it’s the one that everyone in our industry watches very closely. The main key takeaway from this graph is that in a “normal” year, with a stable market, the typical price of urea is between $200 and $300 a ton. At least that’s what most of us think of as “normal” in terms of what we expect to pay for urea. During the majority of 2020, that’s precisely what we had. Despite the beginning of the pandemic in the spring of 2020, the market held its strength until multiple associated factors began to impact the supply availability towards the very end of the year. That’s when the market reacted and began to steadily increase, which resulted in crossing the $300 a ton threshold.

About that same time, in December of 2020, multiple European countries were facing a bitterly cold winter. As demand soared for heating and electricity throughout the EU, the natural gas prices shot up to $6.00 to $7.00 per MMBtu, which only six months prior sat at $1.65. Some experts in the gas industry believed that this initial price surge was a temporary phenomenon caused by dislocations attributed to the coronavirus. While other experts said it was only the beginning, specifically highlighting a structural weakness in the EU in that it has become too reliant on imported gas…mostly from Russia. When Russia marched into Ukraine, the market stability for natural gas went massively awry and the prices have continued to grow ever since and are currently valued 10X higher than normal.

The reason this impacts urea so heavily is that natural gas makes up 80-90% of the overall production costs. As natural gas prices have continued to surge, many urea manufacturing plants in the EU have simply stopped producing. Each time a plant closes, it further limits the total global supply and exacerbates the market instability. I’ll dive more into this later in this article.

Domestically, our agricultural farmers played an unintentional role in helping shift the urea market. One of the most defining traits of today’s row crop farmers is that they are masterful planners. This was on display in 2021 and one of the largest reasons why urea prices didn’t rapidly spike in the spring. The farmers had already purchased their urea (and other ammonia products) back in 2020, which helped maintain the urea’s market stability in early 2021. However, for this exact same reason, it’s also one of the largest explanations of why the urea market skyrocketed in the fall. Farmers followed their tried-and-true playbook and bought urea for the 2022 planting season. In a “normal” year, this wouldn’t have been significant, but since the market was already unsettled due to growing supply shortages being recorded around the globe, the market reacted by prices shooting up to almost $900 a ton.

Since that time, we have all been navigating our way through constantly shifting markets trying to secure the needed tons to buy, produce and sell what our industry needs. These supply shortage fears continue to mount for a myriad of reasons that I’ll get more specific about later in this series. The bottom line, however, is that we’re a far cry away from the $200 to $300 a ton urea we’d like to have and are more likely to stay in the $600 to $700 a ton range for the foreseeable future.

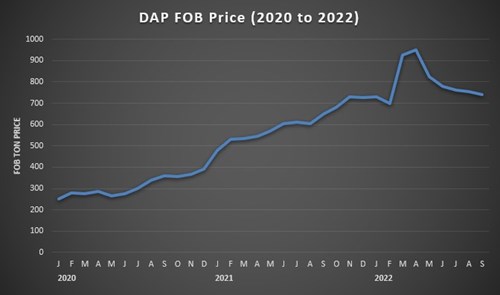

DAP

Phosphate prices, specifically DAP, have been steadily rising in price since before the pandemic. After tying an all-time high price of approximately $950 a ton, it has finally started to show signs of relief over the past six months. For many of the same reasons why urea has climbed to such high levels, DAP is equally impacted by same global supply and demand paradigm, as well as being intimately tied to natural gas for mining production.

In case you aren’t aware of how DAP is produced, here’s a simple explanation. Production of one ton of DAP fertilizer, requires 1.5 to 2 tons of phosphate rock, 0.4 tons of sulfur to dissolve the rock, and 0.2 tons of ammonia. The ammonia is created with natural gas, which as we know, continues to rise in price and, subsequently, causes both supply shortages and price increases of DAP.

Yara, one of the larger suppliers of global phosphates, has been routinely turning on and off European production plants due to high natural gas prices. In 2022, Yara shut down over 45% of its production capacity. While remaining optimistic for 2023, Yara has maintained its stance that it will not produce DAP while its costs are so prohibitive.

The largest impact to the phosphate market continues to be China, which is the world’s biggest phosphates exporter, shipping 10 million tons last year, or about 30% of total world trade. Most recently, China rolled out a quota system to limit exports of phosphates for the remainder of 2022. These quotas, set well below last year’s export levels, would expand China’s intervention in the market in a concerted effort to keep a lid on domestic prices and protect in-country food production. Export quotas have been issued for just over 3 million tons of phosphates to producers for the remainder of 2022, which marks a 45% drop from China’s shipments of 5.5 million tons in the same period a year ago. However, last year, China implemented a new export requirement of inspection certificates for all phosphate fertilizers, which has significantly contributed to decreased exports in an already tight global supply.

Phosphate prices have remained high but do show a glimmer of hope of stabilizing. However, there’s no reason to believe that the global supply will increase enough to meet growing demand. Surging grain prices continue to warrant phosphate applications, maintaining the global demand from farmers around the world. Even when the market does self-correct in terms of the supply and demand aspect, we need to be prepared for higher prices for all phosphates.

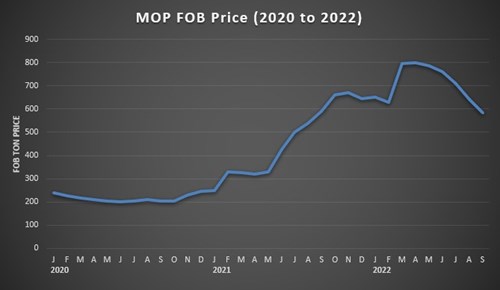

MOP

Muriate of potash is the most heavily used potassium source in the world; representing 95% of all agricultural crop uses. MOP is a vital product that few other countries have at their disposal and are heavily reliant on to make fertilizer blends to grow their much-needed food crops. Since MOP is a mined mineral, it’s somewhat insulated from many of the previously mentioned factors that are impacting urea and phosphates in today’s fertilizer market. However, it does have its own unique issues that are directly causing overall diminished availability and elevated price.

Potash comes from either underground or solution mining. Underground potash deposits come from evaporated sea beds. Boring machines are used to dig out the ore, which is transported to the surface and sent to the processing mill, where the raw ore is crushed and refined to extract the potassium salts. When deposits are located very deep, solution mining is used as an alternative to traditional underground mining. Solution mining employs the use of brine to dissolve water soluble minerals such as potash and magnesium. Wells are drilled down to the salt deposits and the solvent is injected into the ore body to dissolve it. The solution is then pumped to the surface and the minerals are recovered through recrystallization.

With underground mining operations, the specialized boring machines used in the extraction of the sylvinite potash ore run on diesel fuel…a lot of diesel fuel…which in April 2022, hit an all-time high price of $5.16 per gallon. For solution mining operations, the necessary chemicals to formulate the required brine solution experienced supply chain issues, causing availability issues and increased prices. In short, the operational costs for both extraction methods increased significantly.

The overall availability of MOP has been compromised over the past two years due to the limited number of countries that have the natural resource available to mine. In fact, only five countries export more than 90 percent of the world’s MOP supply - Canada, Russia, Belarus, Morocco, and the United States. Canada is the largest exporter of MOP, accounting for approximately 35 percent of all exports. As previously written about, Mosaic Company is one of the world’s leading producers of potash due to having one of the best ore deposits located in Esterhazy, Canada, however they were abruptly forced to close their two primary mine shafts (K1 and K2) due to an unexpected acceleration of brine inflows. These closures directly impacted the availability of MOP which sent the potash market pricing into overdrive. Mosaic announced the reopening of a mine in Saskatchewan which is currently on track to be opened in early 2023.

The real problem with MOP global supply lies squarely with the second and third largest suppliers, Russia and Belarus. Together they supply nearly 33% of the global potassium exports. This has been extremely problematic ever since the invasion of Ukraine back on February 24, 2022.

The geopolitical conflict between Russia and Ukraine is impacting global supply of fertilizers and food. Russia originally imposed restrictions on nitrogen, phosphate, and potash fertilizer exports until June of 2022, effectively removing nearly 15 percent of the global supply. Although these restrictions were announced, the actual imposition of the restrictions is unclear, stemming from Russia’s decision to stop publishing trade data. According to Trade Data Monitor, there are no records of fertilizer exports from Russia since January of 2022. By contrast, many countries, including the United States and Brazil, have reported fertilizer imports from Russia through April 2022. The uncertainty surrounding Russia’s fertilizer supply will likely cause prices to remain elevated until the Russia-Ukraine war ends, because ramping up fertilizer production takes an average of three to five years, even if the necessary reserves are available.

The MOP market continues to see rising prices mostly based on the availability of the supply. As disruptions and uncertainty from any of these major exporters remain prolonged, they will likely continue to cause considerable MOP shortages and increases in prices into 2023.

Natural Gas

Throughout this article, we’ve stressed the importance of the underlying issues that the unprecedented rising natural gas prices have caused on the production logistics and costs of both urea and DAP. They are intrinsically linked because of how they are mass produced. To further explain this connection, you need to understand that to manufacture one ton of urea using the standard Haber-Bosch method, requires the consumption of between 20 to 22 MMBtu of natural gas.

Assuming it takes 20 MMBtu, in March of 2021, it cost approximately $124.20 to produce that one ton of urea. One year later, in March of 2022, it cost approximately $834.60 to produce that same one ton of urea.

This type of economic impact can’t be ignored…and they’re not. Urea production facilities quickly realized that the cost of doing business far outweighed the value of the product being created. In response to these extraordinary natural gas cost increases, many plants simply shut down. Here’s a small list of plants that have recently stopped producing any ammonia products.

August 23, 2022 – Poland’s PKN Orlen SA

August 23, 2022 – Poland’s Grupo Azoty

August 24, 2022 – CF Fertilisers UK

August 25, 2022 – Yara International ASA

September 1, 2022 – Lithunanian Achema

However, there is some recent good news that may indicate the beginning of a downward trend in pricing. The natural gas future’s price has fallen to their lowest level in 2 ½-months as speculation turned optimistic amid reporting of above average natural gas stockpile levels and milder weather forecasts for the winter. Gas storage sites in Germany were 93.1% full as of October 5th, with the entire EU average now reaching 90.1%. Additionally, the EU and Norway agreed to jointly develop tools to stabilize the energy markets and limit the impact of market manipulation and price volatility. Gas supply from Russia currently represents only around 9% of EU’s imports, compared to 40% before the war in Ukraine. Norway is now Europe’s biggest supplier of natural gas.

The impact to the global urea and DAP supply has been increasingly devastating. The growing interruptions to the supply of nutrients causes fear and uncertainty which ultimately contributes to sustained higher prices. At the root of much of this damaging perception is the cost of natural gas. Until such a time as new supplier relationships and logistical obstacles are resolved, this particular Jenga piece will continue to keep the entire tower swaying erratically.

In the second part of this series, I’ll dive into the most meaningful domestic factors that will shape what the fertilizer market will look like in 2023.